Imbibe, an industry-leading beverage development company, announced today the company’s top beverage trend predictions for 2019. While trends won’t differ drastically from 2018, expect products to have a strong global influence and represent a more holistic view of health and wellness by supporting mental, physical and environmental health. Here are the top trends to look for in 2019:

Ingredients

- Hyper-personalized Functional Beverages – Consumers are embracing functional beverages because they are a delicious and convenient way to absorb the inherent benefits of ingredients like turmeric or melatonin that were previously sold as supplements. Functional beverages in 2019 will be hyper-personalized for consumers to achieve overall wellness. Improved sleep, energy, cognitive function, beauty, weight loss and gut health will be the most desired benefits but expect products that support even more personalized needs like oral or cardiovascular health to launch as well. Here are some significant sub-trends within the functional product category:

- Coffee + function – Coffee that delivers health benefits beyond a healthy dose of caffeine will be in the spotlight. This is especially attractive for consumers who demand convenient formats and enjoy getting multiple benefits from a single product. Expect coffee to be fortified with additional functional ingredients like protein, MCT oil, CBD oil, and adaptogens like reishi mushrooms.

- Functional/colorful – Ingredients like blue algae, beet, matcha, butterfly pea flower, and purple tea make beautiful beverages that are chock-full of health benefits which has made them a staple on Instagram. Butterfly pea flower tea will be the rising star of 2019 because it is high in antioxidants and naturally changes color from blue to purple when acidity is added to it. Expect to see more antioxidant-rich purple tea products as well this year if the supply chain matures.

- Superfoods Deep Rooted in Ancient Traditions – Consumers are becoming more familiar with ingredients deep-rooted in Ayurveda and traditional Chinese medicine because they have appeared in products like coffee, smoothies, wellness shots and cold-pressed juices. Turmeric, medicinal mushrooms, schisandra, ashwagandha, and goji berries have a history in these ancient traditions and will be top functional ingredients in new beverage launches.

- More ways to achieve a healthy gut – Probiotic-rich and probiotic-fortified beverages like kombucha, juices and enhanced waters have been popular the last few years and won’t lose momentum in 2019. Shrubs are another gut-friendly beverage category made with fruit and vinegar which is said to alkalize the gut. They’re dominating cocktail menus and appearing in spritzers and mocktails.

- Green Living – Hemp-derived Cannabidiol (CBD) will be a popular ingredient in products across beverage categories next year and beyond. CBD is suggested to aid with pain, nausea, seizures, anxiety and depression which makes it an enticing functional ingredient. It’s also risqué in nature because of the controversial sourcing of the ingredient and that may add to its appeal. Cannabis industry analysts The Brightfield Group predict the U.S. CBD market will reach $591 million this year and $22 billion by 2022 (a five-year CAGR of 132%). On a much smaller scale will be non-alcoholic beverages enhanced with THC in states where cannabis is legal.

- Plant-Based – According to NDP Group, plant-based product claims experienced a CAGR of 62-percent worldwide from 2013 to 2017 and 86-percent of people buying plant-based products are meat-eaters. The reasoning behind flexitarian adoption of plant-based options is likely two-fold: the perception is that plant-based products are better-for-you in moderation and more sustainable than their animal-based counterparts. For beverages, the largest plant-based category is non-dairy milk alternatives . Almond milk has the lion’s share of the category followed by soy and coconut milks, but expect niche plant-based dairy alternative products with better-for-you ingredients like oat, chickpea, and sesame to hit shelves.

Flavors

- Nostalgia – There’s plenty going on in the world causing consumers to be stressed, so food and beverage that trigger pleasant feelings of nostalgia are a welcome distraction. These products may have more sugar, calories or fat, but the benefit of these products is that they bring consumers back to happier times and ease the mind. Products incorporating flavors that incite memories of childhood like cereal milk, s’mores, birthday cake, and cookie dough are evergreen and are especially popular in coffee beverages, protein shakes, and cocktails. Other flavors like pumpkin spice, maple, eggnog and caramel apple are popular in LTOs because they trigger nostalgia inspired by season change and holidays like Thanksgiving and Christmas.

- Globally Inspired Flavors – Ethnic flavors experienced an average annual growth of 20-percent between 2013 and 2017 and this trend will continue in the foreseeable future. Spicy and exotic flavors that derive from Asian and Latin American countries are especially exciting to consumers. Spicy flavors like cardamom, ginger, Chinese Five Spice, cayenne, jalapeño, chili, and habanero will be popular in indulgent beverages, cocktails, coffee, tea and juice. Additionally, true-to-fruit flavors from Latin America and Asia will be widely represented on menus and in RTDs next year. Flavors that have been appearing on a significant number of menus and in RTDs that are expected to gain more momentum in 2019 are yuzu, Meyer lemon, clementine, blood orange, and guava.

Attribute Manipulation

- Textures – As consumers increasingly turn away from traditional CSDs, brands have been playing with texture to provide complexity to other beverages. According to Innova Market Insights, there was a 16-percent increase in sensory claims on food and beverage products from 2013 to 2017. Carbonation will continue to be added to beverages like coffee, tea, and juice. Nitrogen infusions have been primarily used in beer, coffee and tea, but it will expand to more product categories in like juice, protein beverages, and pre-mixed cocktails. Whipped beverages have been around for some time (e.g. Dairy Queen’s Orange Julius), but brands like Peets Coffee and Tea and Nestle launched whipped products in 2018 and more will follow.

- Flash-Brewed Coffee – Also known as Japanese flash iced coffee, is very much an emerging trend, but it’s an important one as many beverage industry professionals have questioned what coffee products will compete with the popularity of cold brew. Proponents of the flash brew method claim the brewing method results in a bright, crisp and full-flavored product. Flash brewed iced coffee is made by brewing hot coffee in an oxygen-free environment with around 60-percent of the water that would ordinarily be used in the brewing process. The hot coffee is poured directly onto an amount of ice equivalent to the remaining 40-percent the brewing water. At cafés this is often done using equipment such as a Chemex or Hario v60, but likely requires proprietary equipment to scale up for RTDs.

Product Claims

- Clean Label – The consumer-driven clean label concept has shifted from a trend to an expectation for brands. Innova Market Insights reports that clean label claims like no preservatives, artificial colors, flavors or sweeteners, Non-GMO, and natural were up 30-percent from 2013-2017. Brands will continue to formulate or reformulate to meet clean label standards of natural, which can differ depending on the brand and consumer. Brands will also aim to differentiate themselves by telling the origin story of their ingredients as a way to appear more transparent to the consumer as well as making free-from claims for unfamiliar ingredients (e.g. carrageenan).

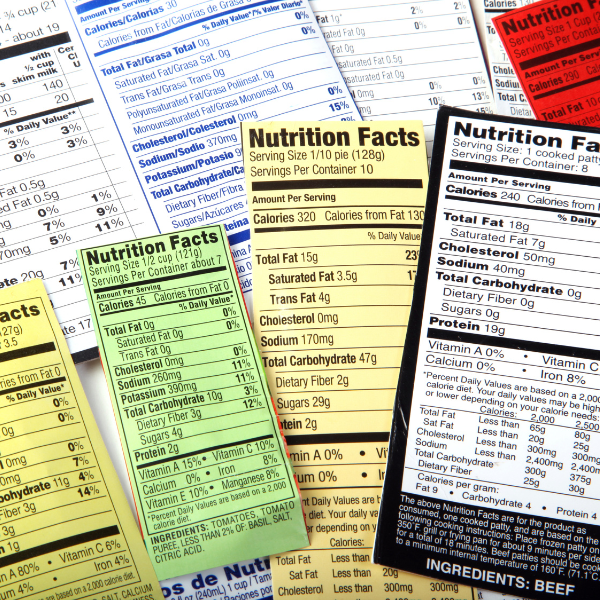

- Sugar Reduction – Sugar reduction is still a top priority for many consumers, and therefore many brands. According to Mintel, 86- percent of consumers are limiting the amount of sugar in their diet. As changes to the nutrition facts panel loom, brands are highlighting “no added sugars,” in products, which will make it a top claim next year. Additionally, because consumers want the same sweet flavor with less sugar many brands are turning to sweeteners like stevia and monk fruit as alternatives. Stevia will dominate the natural, non-nutritive sweetener category since it is approved for use in food and beverage in North American, European and Asian countries and is considered more clean label than artificial sweeteners, which 54-percent of consumers are avoiding according to Nielsen.

- Sustainability – The internet and social media have propelled the sustainability movement by increasing access to information and generating awareness about issues like food waste and global warming. Sustainability claims can significantly impact purchase decisions for everything from homes to beverages because consumers want to reduce their environmental footprint to improve the environment we need to survive. A Unilever survey of 20,000 consumers found that roughly one-third prefer products that help reduce our environmental footprint; additionally, data from Nielsen and Mintel suggests consumers will pay more for products with sustainability claims. Expect more beverages with eco-friendly packaging as well as upcycled and fair-trade ingredients.

Get a full digital report of trends for 2019 and beyond here!